The Office of Clean Energy Demonstrations was supposed to be a launchpad for ambitious projects to help America lead the way on cleaner power and manufacturing. Now it’s been reduced to a shell of itself.

As the Trump administration slashes spending and fires workers across the federal government, the U.S. Department of Energy has emerged as one of the hardest-hit agencies — and perhaps no other of its divisions has been singled out as deliberately as OCED.

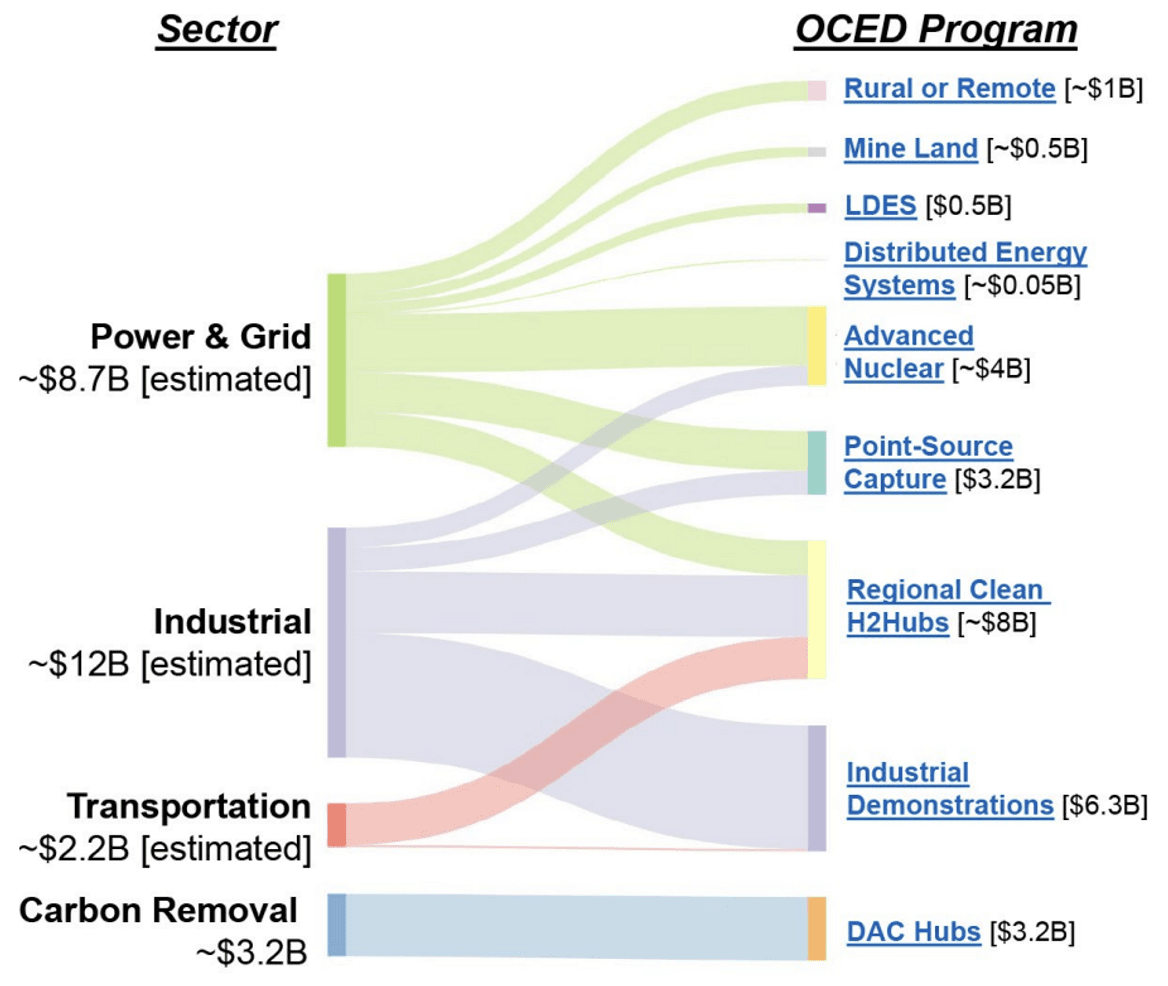

It’s a dramatic reversal for the four-year-old office. During the Biden administration, Congress endowed it with nearly $27 billion to try to scale up cutting-edge technologies that could curb planet-warming pollution from industrial facilities and power plants. Trump officials have in recent months hollowed out the office, canceling billions in previously issued awards for everything from low-carbon chemical manufacturing to rural energy resiliency, while also dismissing over three-quarters of its employees.

The situation is best summarized by the budget the White House has requested for OCED for the next fiscal year: $0.

Experts and insiders warn that the tumult within OCED and the DOE more broadly is eroding the private sector’s trust in the federal government and its ability to drive energy innovation.

“The administration has really created a chilling effect on the willingness of future early-stage technology developers to work with the Department of Energy,” said Advait Arun, a senior associate for energy finance at the Center for Public Enterprise, a nonprofit think tank.

Ultimately, that will stifle investment not only in the clean energy sectors the Trump administration dislikes but in those it has championed as well, such as advanced nuclear and geothermal. Former OCED staffers and contractors, who were granted anonymity to speak freely, told Canary Media that the disruption is a major setback for America’s efforts to launch the world’s next generation of energy technologies and industries.

“We are eliminating ourselves as a leader in the clean energy space, especially for the industrial complex,” one person said. “What I’m seeing is China is about to slip right into that position. Just logically and economically, I don’t understand the steps that are being taken.”

Congress created OCED in December 2021 to help deploy first-of-a-kind projects at commercial scale. The idea was for the government to absorb some of the risks and provide early capital to usher companies across the valley of death that lurks between promising research pilots and real-world operations that can move the needle on decarbonization.

The 2021 bipartisan infrastructure law provided OCED with about $21 billion over five years to scale up emerging technologies like small modular reactors and long-duration energy storage, and to advance ambitious “hubs” for producing hydrogen fuel and capturing carbon dioxide from the sky and smokestacks. In 2022, Congress gave OCED an additional $5.8 billion through the Inflation Reduction Act to help decarbonize U.S. manufacturing of materials like steel, cement, and chemicals.

“A lot of this stuff is a chicken-and-egg situation, where the private sector doesn’t want to come in [and invest] yet because it’s not proven,” said Zahava Urecki, a senior policy analyst with the Bipartisan Policy Center’s Energy Program.

“But we need the technology to go through this [demonstration] process in order to make sure it becomes proven, so that eventually we can have this in society,” she added. “And that’s where the federal government plays a key role.”

Over the course of three years, the office selected 116 projects in 42 states to receive over $25 billion in federal funding. For most awards, participating companies were required to cover at least 50% of total costs themselves — meaning the office expected its portfolio to spur nearly $65 billion in private investment, in addition to creating potentially hundreds of thousands of jobs.

Among the biggest winners were seven regional hydrogen hubs and two major direct-air-capture initiatives that would remove CO2 directly from the sky. The choices were not always broadly celebrated, and critics raised concerns that the hydrogen and carbon-capture initiatives in particular would do more harm than good for the climate by propping up unproven, energy-intensive projects involving fossil-fuel companies.

But other OCED picks garnered more public applause — and supported industries that President Donald Trump had flagged as priorities. In 2024, the office selected Cleveland-Cliffs for an award of up to $500 million to begin lower-carbon steel production in Middletown, Ohio, the hometown of Vice President JD Vance. Another manufacturer, Century Aluminum, got up to $500 million to help it build the nation’s first new aluminum smelter in decades, which would be powered by carbon-free electricity.

Former OCED staffers said they attempted to brief the incoming Trump administration on the office’s portfolio and to explain how they could support the president’s stated goals of boosting “American energy dominance” and “advancing innovation.”

However, from the time Trump took office on Jan. 20, “It became pretty clear that it didn’t really matter,” a former employee said.

It was quickly evident that Trump would, in fact, be adopting the right-wing policy platform Project 2025 after trying to distance himself from it on the campaign trail. The blueprint — which outlines ways to erase federal spending — called for eliminating “all DOE energy demonstration projects, including those in OCED,” in order to avoid “distorting the market and undermining energy reliability.”

For one staffer, “it all started crumbling” on Day 1, when the White House issued an executive order to halt federal work on “diversity, equity, and inclusion” — a measure that affected OCED’s grant recipients. Under former President Joe Biden, the office required participants to create community-benefit plans to ensure the billions in taxpayer dollars went to projects that included neighbors in the planning process and supported local economies. Under Trump, the strategy became a liability.

A blitz of federal funding freezes and layoffs — and court reversals and injunctions — then ensued, creating chaos across federal agencies and for all the outside companies that hold or held government contracts. In late January, the White House extended federal workers a “deferred resignation offer” that would allow people to resign from their jobs and go on leave with pay through Sept. 30, the end of the fiscal year.

Few OCED staffers initially took the offer. But after several months of chaos, about 77% of workers at OCED signed the deal when the White House extended it again in April. Insiders say that figure is likely even higher now. Across the DOE, some 3,200 employees within the agency’s roughly 17,000-person workforce opted to leave.

“That’s when folks at OCED actually started to realize it was going to be personnel changes that would first impact the projects, and not the program cuts,” according to a former employee.

On May 15, about a month after the staff exodus, Energy Secretary Chris Wright said the DOE would begin scrutinizing federal grants to “identify waste of taxpayer dollars.”

The agency started requesting additional information for 179 awards totaling over $15 billion, with a focus on large-scale commercial projects. Wright claimed that these awards were “rushed out the door, particularly in the final days of the Biden administration,” and required further review to ensure that individual projects were “financially sound and economically viable.”

Less than 3% of the over $25 billion in OCED’s awards portfolio had actually been paid to projects as of March 31, in part because larger grants were meant to be doled out in tranches over a long development timeline, according to EFI Foundation, a nonpartisan organization led by Ernest Moniz, who served as energy secretary during the Obama administration.

Project developers interviewed by EFI claimed that, contrary to Wright’s statement, OCED’s “due diligence was more rigorous than what private-sector investors would conduct” and that, rather than undergo the office’s laborious process, “faster decisions would have better aligned with developer timelines,” the foundation said in a June report.

Wright didn’t wait long to begin nixing projects. In late May, he announced the termination of 24 awards issued by OCED totaling over $3.7 billion, including funding for carbon capture and sequestration and projects within the office’s Industrial Demonstrations Program that aimed to reduce emissions from iron, cement, glass, and chemicals production.

“These clean energy projects were enshrined into law by bipartisan majorities and represent the will of Congress,” Sen. Martin Heinrich, Democrat from New Mexico, said in a recent statement to Canary Media. Heinrich and other congressional Democrats sent a letter to Wright on Sept. 9 accusing the DOE of undertaking a “haphazard, disorganized, and politically driven” cancellation process.

More funding cuts arrived earlier this month, when the DOE said it was slashing 321 grants for projects almost entirely in states that voted for Democratic nominee Kamala Harris in the 2024 presidential election. A spreadsheet of the cuts lists 11 newly affected OCED projects totaling nearly $2.5 billion, including for two major hydrogen projects planned in the Pacific Northwest and California. The October list also repeats five OCED-backed initiatives that first appeared in the May announcement.

Project developers have said they’re appealing the award terminations and are in continued talks with the DOE. Still, it’s unclear how much capacity the office has anymore to helm those discussions.

Wright said in an Oct. 3 interview that more cancellations would follow, and early last week rumors swirled about a second spreadsheet that appeared to outline deeper cuts for carbon-removal projects, hydrogen hubs, and other OCED projects. The nature of the list remains unclear, but if it proves to be a signal of cuts to come, it would cancel another $6.1 billion in awards from OCED.

The project areas that have yet to be cut — or to appear on any potential hit lists — include advanced nuclear energy and critical minerals. Additionally, the energy agency said it has started tapping OCED’s authority to make some new grants for Trump’s favorite energy source: coal-fired power plants. Should the office shutter, these awards would likely be managed by other divisions within the DOE.

Alex Kizer, a senior policy advisor at EFI, noted that gutting OCED won’t end America’s efforts to decarbonize heavy industries.

In the case of cement and steel, demand for low-carbon materials is growing within U.S. and global markets as tech giants look to build less carbon-intensive data centers, and as state governments and European and Chinese regulators work to rein in industrial pollution. Still, losing grants — and the DOE’s seal of approval — will undoubtedly make it harder and more expensive for companies to raise private capital for commercial-scale projects. Stifling the DOE’s role as a gatherer and publisher of real-world lessons could further slow progress, Kizer said.

“The potential for breakthrough across different energy sectors is so significant,” he said of OCED’s work, noting that “a relatively small investment from taxpayers could have an enormous benefit to taxpayers over time,” in terms of delivering cleaner, more reliable energy. “Who says no to that?”

Barbara Kelley remembers when her car and windows were routinely coated with a thin film of coal dust that had drifted over from the power plant on the edge of her neighborhood in Salem, Massachusetts. She remembers the noise as a conveyor belt lifted the coal into the building. She also remembers how pleased she was when the community started to discuss the possibility of building an offshore wind terminal on the site when the plant eventually closed.

“The coal plant — it worked, it gave us energy, but it was time to change,” Kelley said. “My reaction was, having a wind port is part of having wind energy — and that’s a good thing.”

In the years since the coal plant shut down in 2014, Kelley and many other community members have worked to promote the goal of transforming part of the property into a staging ground where wind turbine blades, tower sections, and nacelles can be prepared for transport to offshore construction sites south of Cape Cod and north in the Gulf of Maine. The vision was to turn Salem Harbor, one of the country’s oldest ports, into a linchpin of the then-burgeoning offshore wind industry and provide an economic boost to some of Salem’s most disadvantaged residents.

Last year, that dream seemed close at hand. City and state leadership had embraced the idea. The state had promised a hefty investment, and the Biden administration had awarded the project a sizable grant. Massachusetts Gov. Maura Healey attended a groundbreaking ceremony for the development in August 2024, and operations were expected to begin in 2026.

Project developer Crowley had agreed to pour nearly $9 million into a community benefits agreement that included job training, childcare, emergency services, and local sustainability and resilience efforts. Planners estimated construction and operations would create hundreds of jobs. And the whole process of bringing the idea to life gave community members a sense of agency and hope for their city.

Then this August the Trump administration announced that it would cut off $679 million in federal funding for offshore wind ports. The move was part of President Donald Trump’s ongoing attacks on offshore wind, the impacts of which are being felt far beyond the nascent sector. Now, like those in so many communities across the country, the people of Salem find themselves facing the fallout of national political priorities, and wondering whether more than a decade of work will ever bear fruit.

“I feel like we’re all a little bit in the dark still,” said Lucy Corchado, a local activist who was part of the group that negotiated the community benefits agreement. “I hope we hear some good news, but I’m not sure that’s going to happen.”

Community advocates first started floating the idea of building a wind port on Salem Harbor roughly 15 years ago. At the time, plans were underway to build a commercial wind farm off Cape Cod, and the coal plant’s closure looked likely. The advocates saw a promising future for the large industrial waterfront parcel in what seemed to be a growing energy sector.

Once the epicenter of the spice trade in early America, Salem has a deepwater port that today serves mostly recreational boaters, tourist outings, and the occasional cruise ship. Though the city is home to a hospital, university, and thriving hospitality sector, it also has a median household income well below the average in most surrounding towns and statewide.

When the owner of the coal plant proposed building a natural gas–burning facility on the site, activists from Salem Alliance for the Environment, or SAFE, were skeptical of replacing one fossil fuel with another. However, they decided not to oppose the plan for a new, smaller plant and to instead push for the rest of the property to be used for an offshore wind port that could both contribute to the decarbonization of the grid and create new opportunities for local residents.

“It wasn’t that we were really supportive of the gas plant, but we had bigger dreams of a wind port coming into town,” said SAFE founder Patricia Gozemba. “Our dream played out.”

In 2022, then-Gov. Charlie Baker, a Republican, announced the state would make a $75 million investment in the port, and the project was also awarded a $34 million grant from the federal Port Infrastructure Development Program. Two years later, the Massachusetts Clean Energy Center bought 42 acres of the former coal plant property, with the intention of leasing it to energy and marine developer Crowley. The City of Salem acquired five adjacent acres.

The plans enjoyed widespread support in the city.

“We’re a uniquely progressive community,” said SAFE executive director Bonnie Bain. There was no organized opposition to the wind port idea beyond occasional grumbling by Facebook commenters, she said.

As negotiations between Crowley and the city got underway, SAFE and other groups started to worry that, despite their longstanding advocacy for the project, important community input was missing from the process.

“This wasn’t just a wind port — it was an investment in the community,” Bain said. “We want to make sure that when we build projects that they enhance the community.”

Advocates raised their voices, submitting testimony for state and local proceedings, attending planning board meetings, and hosting educational webinars about offshore wind. In 2023, SAFE and several Salem neighborhood associations and civic groups formed a coalition to ask for a seat at the bargaining table as the city and developer hammered out the community benefits agreement.

The coalition was determined to make sure that the project didn’t harm nearby residents and created opportunities for some of the city’s disadvantaged populations. The group met once a week — Thursdays at 4 p.m. — for a year to discuss strategy, write letters to the media, and plan for local and state meetings. Salem Mayor Dominick Pangallo agreed to include two coalition members — Kelley, representing the Historic Derby Street neighborhood adjacent to the planned port, and Corchado, representing The Point, a largely immigrant, lower-income neighborhood nearby — in the community benefit negotiations.

“We kind of pushed our way to the discussion table to make sure they heard what we were looking for,” Corchado said.

The parties struck a deal that included a range of measures. The city’s public schools were set to receive $40,000 annually for technical and vocational education programs and another $50,000 per year to expand prekindergarten childcare to help parents attend job training. Crowley also committed to offer paid apprenticeships and internships, help graduating students find jobs in the industry, and fund scholarships for local workers to access relevant training opportunities.

When Trump was elected in 2024, some port supporters held out hope that the project would escape the president’s well-known hostility to offshore wind. Corchado, however, was concerned from the beginning.

“We were so far along and the funding has already been secured. It was like, maybe it’s not going to be that bad,” she said. “But, yeah … it’s what I was worried about.”

The news on Aug. 29 that the federal funding would be terminated was an enormous disappointment for proponents. It also left them with questions about whether the lost funds would scuttle the plan entirely, force the developer to change course, or merely delay implementation. Crowley will say only that it is reviewing the action and determining next steps. The city of Salem is also figuring out what to do now.

“We are still working to pursue all avenues to address the funding termination,” the mayor’s office said in a statement. “That includes working to get it restored or, failing that, looking at how we could revise the project plan to account for the loss of what was around 10% of the expected construction costs for the port.”

Community members are feeling somewhat adrift as the concrete plans they invested so much time in become increasingly uncertain.

“It wasn’t necessarily surprising,” Bain said. “But it’s still dizzying when it actually happens.”

An enormous solar project planned for the Nevada desert was canceled last week while awaiting final federal approvals, an ominous sign for renewables development on public lands under the Trump administration.

Esmeralda 7 was unique for its size: It would have installed 6.2 gigawatts of solar generation and 5.2 gigawatts of battery capacity across 62,300 acres of Nevada desert. No other solar project in the U.S. comes close to that scale. It was also a test case for a new, more efficient approach to federal permitting, one that promised to get clean energy infrastructure built more quickly.

The solar colossus incorporated seven distinct solar-and-battery projects from different developers on adjacent parcels of land overseen by the federal Bureau of Land Management. Instead of each going through an exhaustive process to attain federal permits, the projects banded together to undergo a joint analysis by the BLM. The bureau completed a draft environmental review of the megaproject under the Biden administration, but didn’t release a final version. Instead, as first reported by Heatmap, the BLM website switched the project status to “canceled” on Thursday.

It’s not yet clear if the decision to cancel was made by the BLM or Interior Secretary Doug Burgum, or if the Esmeralda 7 developers pulled out, perhaps based on conversations with the government. An automated email reply from Scott Distel, the BLM contact for the project, said he is not authorized to work during the government shutdown and thus was unable to respond.

The BLM circulated a statement to media on Friday saying that “applicants will now have the option to submit individual project proposals to the BLM to more effectively analyze potential impacts.” Such a move would entail repeating the already-conducted environmental analysis for each project individually, after which the administration could simply move to cancel the projects again.

“While we await further clarity from BLM on its apparent decision to abruptly cancel these solar projects in the late stages of the review process, we remain deeply concerned that this administration continues to flout the law to the detriment of consumers, the grid, and America’s economic competitiveness,” Ben Norris, vice president of regulatory affairs at the Solar Energy Industries Association, wrote in a statement Friday.

President Donald Trump swept into office declaring an “energy emergency” and pledging to unleash more American energy and bring down prices. Since then, though, his administration has intervened to obstruct several major power projects that would deliver renewable electricity to the grid at a time of swiftly rising power demand.

The White House attempted to halt two fully permitted offshore wind farms, the 810-megawatt Empire Wind 1 and the 704-megawatt Revolution Wind. Offshore wind requires permissions from the Interior Department’s Bureau of Ocean Energy Management, giving the administration leverage over this type of private enterprise. Those efforts to stop construction did not hold up, but they incurred millions of dollars of unanticipated costs for the developers, and damaged the country’s reputation as a safe place to invest in billion-dollar infrastructure projects.

Currently, only 4% of terrestrial, utility-scale renewable capacity sits on federal land, according to the National Renewable Energy Laboratory. But in the U.S. West, many federal parcels are well-suited for renewable energy; if these sites were successfully developed, they could greatly increase clean energy production.

Esmeralda 7 appears to be the first large renewable development on public lands to be officially canceled during the Trump administration, said Ted Kelly, director and lead counsel for U.S. clean energy at the Environmental Defense Fund.

Previously, he added, some projects that were expected to move forward were “sitting in limbo,” neither canceled nor approved on schedule. Now, Kelly said, there’s “a real concern” that public lands may be effectively off limits for wind or solar development for the duration of the Trump administration.

While it lasted, Esmeralda 7 modeled a new, more streamlined way to analyze a huge amount of renewable capacity.

“It increases efficiency on the government side, not having to recreate the same review of the same type of impact over and over again,” Kelly noted. Combining the permitting also helps in scrutinizing the cumulative effect of multiple projects, something environmental advocates have pushed for.

The BLM released its draft environmental impact statement in late July 2024, kicking off a 90-day comment period, which included an in-person public meeting and an online one.

The project would have impacted the desert landscape. But the draft environmental review identified those impacts and outlined mitigation efforts needed to protect endangered species and minimize disruption to desert plants. Esmeralda 7 also would have had environmental benefits by displacing polluting power production with emissions-free generation.

Projects that undergo thorough vetting and abide by the government’s conditions have a legal right to move forward, Kelly said. Under U.S. law, the government can’t cancel a project without mustering a set of reasons and evidence; the Administrative Procedures Act forbids “arbitrary and capricious” decisions that violate due process.

“It’s inconsistent with the law, but it’s also obviously inconsistent with what our country needs,” Kelly said of the cancellation.

Several prominent voices outside the clean energy industry expressed alarm at the news. Utah’s Republican Gov. Spencer Cox blasted the cancellation on X, writing, “This is how we lose the AI/energy arms race with China. … Solar with batteries can now be close to baseload power and we should keep these projects rolling until we get the gas/nuclear/geothermal plants we need.”

Billionaire John Arnold, who made a name for himself as a gas trader at Enron, also tweeted about the cancellation, saying, “I’m increasingly worried we’re headed for the cliff.” Coal, hydropower, and nuclear are not projected to grow much in this decade, he noted, so “all growth has to come from gas, solar & wind.”

Halting new wind and solar developments thus threatens the country’s ability to grow electricity supply even as AI companies and leaders in other industries are in desperate need of more power.

See more from Canary Media’s “Chart of the week” column.

Renewable energy just notched a major milestone.

Worldwide, renewables produced more electricity than coal across the first half of this year — a first, according to clean-energy think tank Ember.

The global revolution in solar deployment made the milestone possible. The energy source more than doubled its share of global electricity generation over the last four years alone, rising from 3.8% in 2021 to 8.8% in the first half of 2025. Wind power also grew modestly during the first half of the year.

Taken together, the two clean-energy sources increased fast enough to not only meet all new electricity demand in the first six months of 2025, but to displace a bit of fossil fuel use as well.

Despite the progress, coal remains the single largest source of electricity in the world. No renewable-energy source on its own — be it wind, solar, hydro, or bioenergy — measures up to coal. And although renewable energy on the whole has now surpassed coal, it’s not like coal generation is plummeting. Power plants still plowed through more coal in the first half of this year than they did in the first half of 2021.

But coal power is stagnant. Meanwhile, renewables, and solar in particular, are ascendant. This latest milestone is worth celebrating not because fossil fuel use has been dealt a fatal blow, but because it’s a clear illustration of the trajectory each energy source is on.

For the world to truly reorient itself around energy sources that don’t bake the planet and spew toxic fumes into the air, those trends must not only continue but accelerate. Coal — and eventually gas — will need to decline as assuredly as renewables soar. Let’s call this a step in that direction.

This analysis and news roundup comes from the Canary Media Weekly newsletter. Sign up to get it every Friday.

The specter of additional, deeper federal funding cuts is haunting the clean-energy sector. A Department of Energy list shared this week with Canary Media suggests the agency is thinking about canceling a whopping $23 billion worth of energy projects.

Well, maybe.

Here’s what we know for sure: Last week, the DOE terminated $7.56 billion in federal funding for grid upgrades and energy projects, which were largely set to benefit Democratic-voting states. Right after, Energy Secretary Chris Wright called the announcement a “partial list” and promised that more cuts were coming — in both blue states and red ones.

From there, it gets fuzzier.

On Tuesday, sources shared a leaked spreadsheet with Canary Media that looks a lot like a follow-up to last week’s hit list. It lists the word “terminate” next to not only the 321 grant cancellations from last week, but hundreds of other projects too.

But despite headlines declaring this a new wave of grant cancellations, the exact nature of the list remains murky. A former DOE official who spoke on condition of anonymity told Canary Media’s Jeff St. John that the list is legitimate and that it represents the grants DOE officials have recommended for cancellation to the White House.

DOE, meanwhile, hasn’t confirmed the list’s authenticity and denies that it has yet decided to cancel any of the projects that appear only on the second list. In a statement, the DOE said it is still conducting an “individualized and thorough review of financial awards made by the previous administration,” and that “no determinations have been made other than what has been previously announced.”

Recipients who appeared only on the second list also say they haven’t heard that their grants will be canceled.

Vikrum Aiyer, global policy head at carbon-capture startup Heirloom, whose major direct-air capture project was included on the second list, told Canary Media’s Maria Gallucci that the company wasn’t “aware of a decision from DOE” to cancel its federal award.

Alliant Energy, a utility holding company whose Wisconsin Power and Light subsidiary was listed on the new spreadsheet, said in a statement that it has not been made aware of changes to its DOE grants.

And aside from the two blue-state hydrogen hubs whose funding was cut last week, several of the firms working on the other five hubs have yet to receive cancellation notices, Alexander C. Kaufman reports.

At best, the latest leaked list is just another layer of chaos and uncertainty for federal funding recipients, who are stuck trying to get answers about the status of their projects from a department that has been depleted by layoffs. At worst, though, it’s a harbinger of billions more in cuts to come for innovative American energy projects.

— Jeff St. John, Kari Lydersen, and Alexander C. Kaufman contributed reporting.

State and federal hurdles pile up for community solar

Community solar is in trouble, and it’s not just because of federal shakeups, Canary Media’s Alison F. Takemura reports. These shared arrays help make solar power accessible to those who can’t put panels on their own roofs, whether that’s because they rent, can’t afford them, or face other barriers. That power can in turn help households reduce their bills.

But the One Big Beautiful Bill Act signed in July set an early sunset for tax credits that can cover as much as half of a community solar array’s cost. And states are also contributing to the decline. Developers in New York, a major community solar market, are facing higher costs for land and permitting, while in Maine, developers have to reckon with changes to its solar net-metering program, as well as lowered compensation and new fees for community solar projects.

Those state challenges, combined with the looming threat of more federal funding cuts, have all led Wood Mackenzie to reduce its forecast of new community solar installations by 8% through 2030.

Global clean energy keeps growing

Two new reports contain some good news for clean energy around the globe. For starters, solar and wind installations outpaced global power demand growth in the first half of this year, according to an analysis out this week from think tank Ember. And in a first, renewables also generated more power than coal over the same period.

The International Energy Agency meanwhile predicts renewables’ global expansion will continue. Renewable power installations will more than double by 2030, it forecasts, with solar accounting for 80% of that new generation. That’s some fast growth, but it’s still well short of the tripling the agency has called for to mitigate the worst effects of climate change.

Clean power down under: Australia’s grid operator says replacing its coal-dominated system with 100% renewables is not just a climate-conscious choice, but the lowest-cost choice as well. (Canary Media)

Actual good news for wind: Dominion Energy’s Virginia offshore wind project is on track to start delivering power by March 2026, and is set to be the country’s biggest by far when it’s completed at the end of 2026. (Canary Media)

Tesla’s new price point: Tesla announces a cheaper version of its Model Y SUV and its Model 3 sedan, both with base models starting below $40,000. (CNBC)

Fighting for solar: A labor union, solar installation companies, nonprofits, and other groups sue the Trump administration over its rollback of the $7 billion Solar for All program. (Associated Press)

Coal’s collapse: A low bid for a federal coal lease and the early shutdown of New England’s last coal power plant showcase how the fuel’s economic case continues to shrink even as the Trump administration tries to prop the industry up. (Associated Press, Canary Media)

A windfall for storage: Battery storage startup Base Power raises $1 billion to expand its mission of building home battery systems that it leases to households and uses as a grid resource. (Canary Media)

Weatherization works: Efficiency programs in New England and New York are set to save residents tens of billions of dollars, even as states face pressure to cut spending on such efforts in the name of short-term bill savings, a new report concludes. (Utility Dive)

A correction was made on Oct. 10, 2025: Heirloom has a direct-air carbon capture project, not a hydrogen-hub project.

In July, China launched the world’s largest green hydrogen plant. One month later, India’s government backed 19 projects designed to make the country a leader in producing green hydrogen, which could help decarbonize everything from steel to shipping. Saudi Arabia and the United Arab Emirates are pumping billions of dollars into infrastructure to produce and export the fuel over the next few years.

The United States, meanwhile, is yanking funding for some of its most ambitious clean-hydrogen projects.

Last week, as part of a list of 321 grants revoked in the name of saving $7.5 billion in spending, the Department of Energy rescinded $2.2 billion in awards to two of the seven hydrogen regional hubs established under the bipartisan Infrastructure Investment and Jobs Act. Unlike the five other hubs, the law designed the terminated projects, in California and the Pacific Northwest, to focus exclusively on hydrogen made with renewable electricity, making them an easy target as the Trump administration slashes Biden-era clean energy projects.

Now this week a second Energy Department list shared with Canary Media indicates the agency is considering whether to pull funding from all seven hydrogen hubs, including those in Texas, Appalachia, and the mid-Atlantic and two in the Midwest.

It’s not certain whether the entire $24 billion worth of awards on the new list will be eliminated. Companies whose projects appeared only on the second list, including utilities and carbon removal firms, have yet to receive notice of cancellation. While federal officials gave companies involved in the West Coast hubs a warning before announcing the cuts last week, three separate producers involved in the other five hubs had not heard from the administration as of Thursday, according to California Hydrogen Business Council CEO Katrina Fritz, who checked in with the sources.

But already, the potential cuts are sowing doubt within the emerging sector — and in the clean energy space more broadly.

“Any amount of uncertainty in funding is really detrimental to private-sector investment, and that’s just not a good way to spur innovation domestically and compete on a global stage,” said Rachel Starr, the senior U.S. policy manager for the hydrogen program at the Clean Air Task Force. “Plenty of other countries are investing in this. We’re going to lose our competitive edge if we stop.”

“Yeah, I’m worried”

It remains unclear whether the document outlining a fuller list of cuts, which a lobbyist told E&E News was weeks old, represents an expansion of the previous cuts or a maximalist proposal from which the earlier terminations were whittled down.

In a statement, the Energy Department said it was “unable to verify” the list but that the agency “continues to conduct an individualized and thorough review of financial awards made by the previous administration.”

A former Energy Department official with direct knowledge confirmed that the list is legitimate and said that it represents the grants DOE officials have recommended for cancellation to the White House. The official suggested that the agency is obfuscating its plans to pull the grants to regional hubs in red states until after a federal budget is passed, an effort to prevent congressional Republicans from adding an amendment that preserves the funding into the budget.

“They can’t do that in the middle of a government shutdown,” the official, who spoke on condition of anonymity, told Canary Media. “I do expect them to cancel these funds … [but] not until there’s a full-year appropriations [bill].”

Already, key Republican lawmakers have expressed concern.

“Yeah, I’m worried,” Senate Environment and Public Works Committee Chair Shelley Moore Capito told E&E News when asked about the possibility of losing funding for West Virginia’s hydrogen hub. “It’s a big deal for us.”

The uncertainty only adds to the challenges facing the hydrogen industry.

The Biden administration created a two-pronged hydrogen strategy via the bipartisan infrastructure law and the Inflation Reduction Act. The IRA’s tax credit for clean hydrogen production, known as 45V, was meant to help spur supply of the fuel. The policy survived the rollbacks in the One Big Beautiful Bill Act that Trump signed in July, but Republicans shortened the timeline for the write-offs from 10 years to two.

The hydrogen hubs, meanwhile, were meant to coordinate producers and offtakers to create regional ecosystems that could someday be interconnected with pipelines and other infrastructure. Even before the cuts, however, the hubs were struggling to generate enough demand.

“Low demand explains why the West Coast hydrogen ambitions have never amounted to much,” Martin Tengler, the analyst who heads the hydrogen research team at the consultancy BloombergNEF, wrote in a memo to investors Monday. “Low demand stems from a lack of incentives such as the quotas or carbon prices that are present in Europe, combined with a focus on sectors where hydrogen use is highly uneconomical.”

As a result, he argued, the decision to slash funding for those two hubs “has little direct impact on the pipeline of projects BloombergNEF has expected to come online by 2030.”

Of the six commercial green hydrogen projects larger than 1 megawatt that the consultancy tracked in its latest outlook report, four have reached a final investment decision and just one is operational. “All five are very small,” the investor note stated.

In an email to Canary Media, Tengler said the impact of eliminating funding for all the hubs “would be negative, but the most important things are the tax credits.”

Back to the States

The hubs won’t necessarily fall apart without the federal grants.

California’s regional hub, known as the Alliance for Renewable Clean Hydrogen Energy Systems, or ARCHES, plans to continue without the financing and could turn to state funds to make up the difference. The Golden State’s newly overhauled cap-and-invest program is one potential source. The state Clean Truck and Bus Vouchers program, known as HVIP, and the California Energy Commission’s Clean Transportation Program Investment Plans could bolster offtakers.

“California has been a hydrogen hub for many years, and it’s getting bigger and bigger,” Fritz said. “It’s already in application. There are people riding on hydrogen fuel-cell buses every day in California.”

Roxana Bekemohammadi, executive director of the U.S. Hydrogen Alliance, said it’s possible that Congress could extend the 45V tax credit before it expires at the end of 2027. But in the meantime, she said, “state-level hydrogen incentives are the most stable path forward.”

Whether states can deliver a green hydrogen industry at scale, however, remains to be seen — and removing billions in federal funding certainly doesn’t make the task easier.

“The cuts to these hubs seem shortsighted and ultimately will result in the loss of jobs in our country,” said Carrie Schoeneberger, an industrial analyst who covers hydrogen for the Natural Resources Defense Council. “This will put the U.S. a step back and threaten U.S. leadership, which is against the stated aims of the current administration for American energy dominance.

Jeff St. John contributed reporting.

The first wind farm slated to plug into New York City’s grid has already endured one political catastrophe this year. Now, a logistical crisis looms on the horizon.

Equinor’s Empire Wind is a 810-megawatt project being built about 20 miles off the shore of Long Island, promising enough energy to power 500,000 homes once completed in 2027. The Trump administration halted construction in April, but allowed it to resume in May. The latest challenge came on Thursday with the unexpected cancellation of a contract for the massive new wind-turbine installation vessel that Equinor had been planning to use on the project next year.

Two shipbuilding companies broke out into a public skirmish — one unexpectedly cancelling a contract and the other threatening legal action — over the construction of the specialized ship. The fate of the vessel, which is already more than 98% complete and floating in Singapore’s waters, is now uncertain.

The cancelled $475 million agreement leaves Equinor scrambling to figure out how to maintain progress and bring Empire Wind online on schedule.

“We have been informed by Maersk of an issue concerning its contract with Seatrium related to the wind turbine installation vessel originally contracted by Empire Offshore Wind LLC for use in 2026,” said an Equinor spokesperson via email. “We are currently assessing the implications of this issue and evaluating available options.”

Only a handful of vessels in the world are capable of lifting, carrying, and piecing together the massive steel components of offshore turbines.

Thursday’s news highlights the complexity of bringing just one U.S. offshore wind farm over the finish line, given the combination of logistical difficulties and political obstacles put up by the Trump administration.

In an email to Canary Media, a Maersk Offshore Wind spokesperson confirmed that the company terminated its building contract with Seatrium “due to delays and related construction issues.” The spokesperson declined to comment further.

Seatrium told Reuters it was evaluating its options for the vessel, including via ongoing talks with Empire Wind, and considering legal action.

Singapore-based Seatrium is fresh off the monumental achievement of berthing a first-of-its-kind offshore-wind installation vessel in U.S. waters. In September, the company delivered the $715 million Charybdis from its Brownsville, Texas, shipyard to the Portsmouth Marine Terminal in Virginia. The American-made vessel is owned by utility Dominion Energy, which immediately put it to work building the largest offshore wind farm in the U.S. The ship’s smooth delivery is a major reason why the Coastal Virginia Offshore Wind farm is progressing fast enough to have a new March 2026 launch date.

The ship’s hull is 472 feet long and 184 feet wide, making it one of the biggest vessels of its kind in the world. And, more importantly, it was built to serve the entire U.S. sector — not just Dominion Energy’s project. In other words, the Charybdis could be a solution to Equinor’s new problem.

“Upon the completion of its charter with [Coastal Virginia Offshore Wind], the versatile Charybdis will be available to support a variety of projects, including offshore wind and other critical heavy lift shoreline projects, such as salvage operations or other energy projects,” said Jeremy Slayton, a Dominion Energy representative, in an email to Canary Media.

An Equinor spokesperson provided no comment about Charybdis but reiterated that the company is exploring all options. Having survived the recent political storm, the company is well positioned to navigate these latest headwinds.

About 30 miles off the coast of Virginia Beach, Virginia, workers have been building America’s largest offshore wind farm at a breakneck pace. The project will start feeding power to the grid by March — the most definitive start date provided by its developer yet.

“First power will occur in Q1 of next year,” Dominion Energy spokesperson Jeremy Slayton told Canary Media. “And we are still on schedule to complete by late 2026.”

In an August earnings call, Dominion Energy CEO Robert Blue provided a vague window of “early 2026” when asked when the 2.6-gigawatt Coastal Virginia Offshore Wind (CVOW) project would start generating renewable power for the energy-hungry state.

As of the end of September, Dominion had installed all 176 turbine foundations — “a big, important milestone,” per Slayton. That accomplishment involved pile-driving 98 foundations into the soft seabed during the five-month stretch when such work is permitted. Good weather helped the work move along quickly, as did the Atlantic Ocean’s unusually quiet hurricane season.

Speed is key when building wind projects under the eye of a president who has called turbines “ugly” and “terrible for tourism” — and who has followed up with attempts to dismantle the industry.

Had CVOW not finished foundation installation by the end of this month, turbine construction would have been delayed until next spring. Federal permitting restricts pile-driving to a May-through-October window to protect migrating North Atlantic right whales. Such a delay would have made CVOW more vulnerable to the wrath of the Trump administration, which has already issued stop-work orders to two offshore wind farms under construction.

But Slayton said the threat of President Donald Trump’s interference doesn’t concern him. CVOW is, after all, one of only two in-progress offshore wind projects that hasn’t been directly attacked by the president.

“Our project has enjoyed bipartisan support from the beginning,” he said, pointing to backing from some of the state’s leading Republicans, including Gov. Glenn Youngkin and U.S. Rep. Jen Kiggans.

Kiggans, who represents the politically moderate Virginia Beach area, brought her concerns about Trump’s escalating war on wind to the House floor last month, when Congress returned from recess. She called CVOW “important to Virginia,” and House Speaker Mike Johnson (R-Louisiana) later told reporters that he relayed Kiggans’ message directly to Trump.

“I understand the priority for Virginians and we want to do right by them, so we’ll see,” Johnson told Politico’s E&E News, in a comment that broke from an anti–offshore wind narrative that’s taken root among many of his fellow House Republicans.

The project is crucial for helping the state meet a deluge of new electricity demand, as Virginia is at the center of the nationwide boom in data-center construction. CVOW will provide a huge amount of carbon-free power to the state and Dominion, its largest utility — helping both keep pace with rising demand without having to burn more polluting fossil fuels.

Kiggans also tied the success of CVOW to the needs of Virginia’s military installations.

“I always speak about that project in light of the national security benefit and that benefit to Naval Air Station Oceana,” Kiggans said last month in an interview with WAVY, a Virginia news station, noting that a partnership with Dominion is “giving Naval Air Station Oceana a $500 million power grid upgrade.”

Dominion has already spent $6 billion on the monumental effort to build CVOW, which has been 12 years in the making. Almost $1 billion of that investment has flowed to the local economy, creating 802 full- and part-time jobs in the state’s Hampton Roads region, according to G.T. Hollett, Dominion Energy’s director of offshore wind.

CVOW’s benefits are being felt nationwide too.

“The project has already created 2,000 direct and indirect American jobs and generated $2 billion in economic activity, strengthening the nation’s manufacturing supply chains and our regional economy,” said Katharine Kollins, president of Southeastern Wind Coalition.

Now Dominion will turn to the final phase of construction: turbine installation. The work is made possible by Charybdis — the first U.S.-built, Jones Act–compliant wind-turbine installation vessel — which arrived in Virginia’s Portsmouth Marine Terminal last month.

“When Charybdis is loaded up, it will have all the components to install four turbines with each trip,” said Slayton, who noted that the pace of the build is well timed given Virginia’s data-center boom. The state is facing “record growth and energy demand … maybe you’ve heard.”

Power demand from data centers threatens to scuttle utility decarbonization goals, push grid infrastructure to the brink, and drive up electricity costs for everyday customers already struggling to pay their bills.

But a new report identifies a strategy that utility planners can take to avoid these problems while still providing data centers with the massive amounts of power they require. They simply need to convince data centers to use less electricity from time to time — and they need to do so early in the utility planning process, when it’s still a win-win for both developers and utilities.

The report, based on research conducted by analysis firms GridLab and Telos Energy, used NV Energy, Nevada’s biggest utility, as a case study. According to its numbers, NV Energy could save hundreds of millions of dollars and defer hundreds of megawatts of “new firm capacity needs” — i.e., fossil-gas-fired power plants — if the proposed new data centers in its territory agree to be flexible.

But all these benefits are predicated on that flexibility being “factored into resource planning early on rather than being an afterthought,” Priya Sreedharan, a senior program director at GridLab, said during a webinar last week. Without that vital early work, utilities will lock in multibillion-dollar investments to manage the grid peaks that they assume inflexible data centers will cause.

And once those plans are in motion, the chief incentive for data-center developers to commit to being flexible with their energy — getting faster grid interconnections — will evaporate.

Grid planners and utilities face an unprecedented wave of power demand as tech giants race to build data centers to support their artificial-intelligence ambitions. In many cases, plans for new data centers — the largest of which can use as much power as a small city — are spurring the construction of new fossil-fueled power plants, putting decarbonization further out of reach and raising costs for consumers.

The GridLab–Telos Energy report adds to a growing body of work identifying flexibility as a way for data centers to connect to the grid quickly without causing utility costs and emissions to skyrocket.

To become flexible, data centers will need to invest in gas-fired generators, batteries, solar panels, or other resources to supply their own power needs during times of peak demand. Or they’ll need to take on the technically complex task of ramping down power-hungry computing processes when the grid is under the greatest stress.

Data centers won’t do that just to save money on their electric bills, said Derek Stenclik, founding partner at Telos Energy. But they might do it to speed up when they get connected to the grid — or, in data-center parlance, “time to power.”

In some parts of the country, data centers are struggling to get the grid connections they need even though they’re willing to pay extremely high power prices to secure them. That’s because building the power plants and grid infrastructure to meet their demands can take years.

“If you go to a prospective data center and say, ‘Hey, with our queue, it’s going to take five years for us to bring on new resources to build the transmission to get to you and you can wait five years, or we can interconnect you in two years if you’re willing to curtail 10 to 12 hours a year,’ the answer there will be much, much different than if you’re asking them after they’ve been designed,” Stenclik said.

GridLab and Telos Energy chose NV Energy as a test case for a few reasons.

First, the utility has a ton of new data centers trying to connect to its grid — enough to add 2 gigawatts of peak load by 2030 — and keeping up with that demand will be expensive. Former NV Energy CEO Doug Cannon told the Nevada Appeal in February that the utility may need “billions of dollars of investment” to “double, triple, even quadruple the size of the total electric grid” in the northern Nevada region where most of the new data centers are being built.

Second, GridLab and Telos were ready to model the impact of flexible data centers in the region because they served as experts for groups intervening in the utility’s 2024 integrated resource plan. Utilities, regulators, and other stakeholders use these plans to figure out what mix of generation resources are required to meet future grid needs.

NV Energy’s latest plan calls for converting a coal-fired power plant in northern Nevada to run on fossil gas, rather than building solar and batteries at the site, as it had previously proposed — a decision opponents are formally challenging because they argue it will increase customer costs. Like many U.S. utilities, NV Energy faces backlash over rising rates, including an overcharging scandal that coincided with Cannon’s resignation in May.

Similar load-growth pressures driven by the AI data-center boom are pushing utilities across the country to plan far more new gas-fired power plants, at great cost not only to the climate but also to customers, who will pay higher bills to cover the cost of building and fueling them. Data centers are already pushing up electricity rates in some parts of the country.

Flexible data centers could make a big dent in these costs by allowing utilities to rely more on solar and batteries, which are less costly and faster to build than gas plants. GridLab and Telos Energy’s fact sheet on their analysis of NV Energy found that “even modest levels of load flexibility can yield large capacity savings.”

Specifically, the report found that 1 GW of data-center flexibility could defer from 665 to 865 megawatts of new firm capacity needs and save $300 million to $400 million through 2050. Those savings would come from alleviating the utility’s need to build more gas-fired power plants and from substituting more “lower cost ‘energy’ focused resources such as solar plus storage.”

Getting data centers to commit to energy-flexible operations could make a huge difference across the country, according to Tyler Norris, a Duke University doctoral fellow who is a former solar developer and special adviser at the Department of Energy. He co-authored an analysis released in February that found nearly 100 gigawatts of existing capacity on U.S. grids for data centers that can commit to a certain level of flexibility.

Getting data centers to ease off during specific hours of the year is eminently feasible, Norris argued in an August presentation to state utility regulators. Data centers’ “capacity utilization” rates — a measure of how much of their total potential power demand they’re using across all hours of the year — are all over the map, with some analyses estimating rates as low as 50%.

But utility planners can’t build a grid around estimates, and data-center developers don’t have good reasons to commit to using less power unless they see a clear reward.

“Not even the most sophisticated data center owner-operators necessarily know what their utilization rates and load shapes will look like,” Norris wrote in an August blog post. “Their preference is generally to maintain maximal optionality” — that is, to demand as much access to as much always-available power as they can get.

Nor do data centers have a clear path to achieve the kind of flexibility that utility planners may demand, said Ben Hertz-Shargel, global head of grid-edge research for analytics firm Wood Mackenzie.

“There are two main ways to make data centers flexible,” Hertz-Shargel said. “You can make the compute flexible. Or you can use backup generation, which is almost always diesel today.”

But data centers can’t run megawatts of noisy, polluting, and expensive diesel generators without running afoul of air-quality regulations and enraging neighbors, he said. True flexibility will require more novel options like gas-fired generators and batteries charged from the grid or on-site solar systems, he added.

Meanwhile, flexible computing is in its early stages. Of the major tech giants, only Google has actively engaged with utilities to shift computing to match grid needs. Experiments from companies such as Emerald AI have shown “some auspicious results,” Hertz-Shargel said. “But for the industry to count on that, it’s too early.”

Utilities and regulators will also need to adapt how they plan for serving flexible data centers, Telos Energy’s Stenclik said. Today, they’re taking on rising data-center costs in a multitude of ways, from crafting special tariffs to govern their impact to allowing tech giants to contract for 24/7 clean energy resources in order to supply their power demands. But he wasn’t aware of any utility that has undertaken a real-world version of the kind of demand-side flexibility analysis that GridLab and Telos did.

Utilities should start working on it, given the alternatives, he said. “We’re leading to higher total capacity needs. We’ve seen huge challenges on the supply chain. We’re out five, six years from new gas turbines now,” he estimated.

“I think there’s a ton of latent flexibility,” he concluded. “We’re just asking for it at the wrong time. If you ask for it when they’re already built and designed and on the system, the answer is going to be no. If we trade speed to interconnect for flexibility, I think the answer will absolutely be yes.”

Investment in cleantech startups is tracking toward the lowest level in years. But Base Power shrugged off the market trends and just raised $1 billion to turbocharge its home battery buildout.

The colossal Series C funding round comes only six months after it raised $200 million in an April Series B. Addition led the latest round, which brought back all previous investors, including Andreessen Horowitz and Valor Equity Partners. The company’s valuation now stands at $4 billion after receiving the new investment, Base Power founder and CEO Zach Dell said.

The pace and scale of those investments put the Austin, Texas–based firm in a league of its own among clean energy startups this year — beating out even the outlandish $863 million that Commonwealth Fusion Systems raised in August. Dell says his company’s traction comes down to a very clear value proposition: It’s potentially the fastest way to expand on-demand grid power at a time when everyone wants more of it.

“Right now, we’re in a capacity crunch — everyone needs capacity,” Dell said. “We install capacity faster and cheaper than really anyone out there.”

The U.S. is going through the fastest electricity demand growth in decades, as AI data centers proliferate, more factories open up, and customers purchase electric vehicles. Utilities have long maintained a skeptical stance toward startups’ plans to turn home energy devices into substantial forces on the grid; now, Dell said, they’re not just willing but “more excited than ever” to have that conversation.

The key to Base Power’s model is finding households in Texas who want cheap electricity with the benefit of backup power. The company becomes their retail power provider and installs one or two unusually large batteries on-site. Base owns the batteries, and the customers pay an installation fee starting at $695 and a small monthly rate instead of purchasing them for many thousands of dollars. Then the startup aggregates this dispersed fleet of batteries to essentially create miniature power plants it can profit from in the state’s competitive energy market.

The batteries earn money through simple arbitrage: They charge up when wind or solar production pushes prices down and then discharge when demand and prices spike. Base Power also earned certification to deliver ancillary services, which are rapid-fire adjustments to maintain grid reliability, for which batteries are uniquely suited. The company has already maxed out the 20 megawatts it can bid through the Aggregate Distributed Energy Resource pilot, a virtual-power-plant program, and is pushing for the cap to be raised, Dell said.

Base Power has begun selling its services to regulated utilities so that they can help their customers with backup power and free up more grid capacity. And Dell is scoping out other geographical markets where the rules could allow the Base Power model to grow. But for now, Texas is the ideal place to start. It not only has the competitive market run by the Electric Reliability Council of Texas, or ERCOT, but it is also awash in more utility-scale solar and wind than any other state, enhancing the value of battery-based arbitrage.

When Dell spoke to Canary Media for the previous fundraise, he employed 100 people, and his in-house teams were installing 20 home battery systems per day, for a total of about 10 megawatt-hours in March. Now Base Power employs 250 people and installs double that rate. A year from now, Dell wants to install 100 megawatt-hours per month.

That’s a brash goal for a 2-year-old company. But Base Power has actually followed through on its goals, a rare distinction among buzzy cleantech startups. In April, Dell had promised 100 megawatt-hours of cumulative installations by midsummer; he hit that target and is now approaching 150 megawatt-hours.

The firm has also been planning to move from contract manufacturing for its bespoke battery enclosures to in-house manufacturing. In April, Dell said he planned to break ground on a factory near Austin by the end of the year. Now the company has leased the old Austin American-Statesman newspaper headquarters in the heart of town and has begun moving in manufacturing equipment.

“It’s a 90,000-square-foot empty warehouse that happens to be right across the street from our HQ. There’s massive amounts of benefits you get from colocating engineering and manufacturing — having the engineers be really close to the factory, being able to walk the line and make iterations in real time.”

This factory will take imported battery cells and build the modules, packs, and power electronics needed to turn them into large home-battery products. The plan is to start manufacturing in the first quarter of 2026 and ramp up to 4 gigawatt-hours per year of production capacity, Dell said. This supply chain strategy also shores up compliance with new federal rules limiting tax credits for batteries that contain too much content from China.

Base Power is already finalizing a location for a “much, much larger” facility outside Austin to continue growing its manufacturing capacity.

Other startups have opted for “capital light” strategies to get solar or batteries into the hands of customers. Base Power, in contrast, went capital-heavy, fronting the money to design, own, and install the batteries with the expectation of making future profits on their capacity. It’s too soon to know how that business bet will play out over years, but Dell indicated the early returns were attractive.

“It’s hard to raise a billion dollars without that,” he noted. “The math is indeed mathing.”