STORAGE: Illinois lawmakers consider establishing energy storage incentives as a new study suggests ramping up storage may be the most realistic path for maintaining grid reliability as the state phases out fossil fuels. (Energy News Network)

ELECTRIC VEHICLES:

CLEAN ENERGY:

UTILITIES: CenterPoint Energy issues a request for proposals from developers to build hundreds of megawatts of renewable energy and other generation sources as part of its long-term energy strategy in Indiana. (Utility Dive)

GRID:

WORKFORCE:

COAL: Consumers Energy will soon offer public tours of a coal plant along Lake Michigan that’s scheduled to be decommissioned within the next year. (MLive, subscription)

COMMENTARY:

A major expansion of battery storage may be the most economical and environmentally beneficial way for Illinois to maintain grid reliability as it phases out fossil fuel generation, a new study finds.

The analysis was commissioned by the nonprofit Clean Grid Alliance and solar organizations as state lawmakers consider proposed incentives for private developers to build battery storage.

“The outlook is not great for bringing on major amounts of new capacity to replace the retiring capacity,” said Mark Pruitt, former head of the Illinois Power Agency and author of the study, which suggests batteries will be a more realistic path forward than a massive buildout of new generation and transmission infrastructure.

The proposed legislation — SB 3959 and HB 5856 — would require the Illinois Power Agency to procure energy storage capacity for deployment by utilities ComEd and Ameren. Payments would be based on the difference between energy market prices and the costs of charging batteries off-peak, to ensure the storage would be profitable. The need for incentives would theoretically ratchet down over time.

“As market prices for power go up, your incentive goes down,” Pruit said. “The idea is to provide an incentive that bridges the gap between the cost of battery technology and the value in the market. Over time, those will equalize and level out.”

The bills, introduced in May at the end of the legislature’s spring session, would amend existing energy law to add energy storage incentives to state policy, along with existing incentives for nuclear and renewables.

The study noted that Illinois will need at least 8,500 new megawatts of capacity and possibly as much as 15,000 new megawatts between 2030 and 2049, with increased demand driven in part by the growth of data centers. Twenty-five data centers being proposed in Illinois would use as much energy as the state’s five nuclear plants generate, according to nuclear plant owner Exelon’s CEO Calvin Butler Jr., quoted by Bloomberg.

The North American Electric Reliability Corporation (NERC) found in its summer and winter 2024 assessments that within MISO and PJM regional grids, Wisconsin, Michigan, Minnesota, Illinois and Indiana are all at “elevated” risk of insufficient capacity.

“NERC, PJM, MISO and the Illinois Commerce Commission have all identified the potential for capacity shortfalls,” said Pruitt. “You do have some options for alleviating that. You can build transmission and bring in capacity from outside the state. You can maintain your current domestic generating capacity [without retiring fossil fuel plants]. You could expand your domestic generating capacity. And an independent variable is your growth rate. All these have to work together, there’s no silver bullet. We know there are major challenges on each of those fronts.”

The latest PJM capacity auction results showed capacity prices increasing from $28.92/MW-Day for the 2024/25 period to $269.92/MW-Day — a nearly 10-fold increase — for the following year. That “translates into an annual cost increase of about $350 for a typical single-family household served by ComEd,” Pruitt said. “The increase in costs indicates that more capacity supply is required to meet capacity demand in the future.”

There are many new generation projects in the queue for interconnection by MISO and PJM, but many of them drop out before ever being deployed because of unviable economics, long delays, regulatory challenges and other issues. A recent study by Lawrence Berkeley National Laboratory noted that while interconnection requests for renewables have skyrocketed since the Inflation Reduction Act, only 15% of interconnected capacity was actually completed in PJM and MISO between 2000 and 2018, and experts say similar completion rates persist.

“This finding indicates that deploying sufficient new capacity resources to offset [fossil fuel] retirements is not likely to occur in the near term,” said Pruitt. “Just because something is planned doesn’t mean it gets built.”

Meanwhile the state is running out of funds for the purchase of renewable energy credits (RECs) that are crucial to driving wind and solar development. The 2024 long-term renewable resources procurement plan by the IPA shows the state’s fund for renewables reaching a deficit in 2028, so that spending on RECs from renewables will have to be scaled back by as much as 60%.

Long-distance transmission lines could bring wind energy or other electricity from out of state. But planned transmission lines have faced hurdles. The Grain Belt Express transmission line, in the works for a decade, was in August denied needed approval from an Illinois appellate court. The transmission line, proposed by Invenergy, would have brought wind power from Kansas to load centers to the east.

“That sets it back years,” Pruitt said. “Transmission is a very long-term solution. I’m sure people are working diligently on it, but it’s five to 10 years before you get something approved and built.”

Pruitt’s study found that if 8,500 MW of energy storage were deployed between 2030 and 2049, Illinois customers could see up to $3 billion in savings compared to if they had to foot the bill for increased capacity without new storage. The savings would come because of lower market prices in capacity auctions, as well as investment in new transmission and generation that would be avoided.

Pruitt found that $11 billion to $28 billion in macro-level economic benefits could also result, with blackouts avoided, reduced fossil fuel emissions and jobs and economic stimulus created.

Pruitt’s analysis indicates that the incentives proposed in the legislation would cost $6.4 billion to customers. But the storage would result in $9.4 billion in savings compared to the status quo, hence a $3 billion overall savings between 2030 and 2049.

“Solar is great, but solar is an intermittent resource; battery storage when paired with solar allows it to be far more reliable,” said Andrew Linhares, Central Region senior manager for the Solar Energy Industry Association. “Battery storage is not as cheap as solar, but its reliability is its hallmark. Combining the resources gives you a cheap and reliable resource.”

“Solar and storage is this powerful tool that can help reduce costs for consumers and create new jobs and economic activity,” he continued. “I don’t believe that same picture is there for building out new natural gas resources. Anything that helps storage, helps solar and vice versa. CEJA sees these two technologies as being joined at the hip for the future, they are being seen more and more as a single resource.”

GRID: New England public advocates say they’re concerned with the structure and cost of Eversource’s proposed $384 million transmission line upgrade project, which they say is overkill given that much of the line is still in good shape. (NHPR)

FOSSIL FUELS: A Bitcoin miner in upstate New York sues the state after being denied an air permit renewal for the gas plant powering its operations. (Gothamist)

SOLAR:

BATTERIES: A Hydro-Québec subsidiary says its first utility-scale battery energy and storage system in the U.S., a 3 MW facility in Troy, Vermont, is now operational. (news release)

BUILDINGS: New York’s governor is “facing pressure on all sides” amid final rulemaking that aims to set emissions standards for refrigerants in commercial refrigerators, residential heat pumps and chillers over the next decade. (E&E News, subscription)

BIOENERGY: In Pennsylvania, a renewable natural gas plant at a Bethlehem landfill officially opens, with enough capacity to heat 14,000 homes. (Lehigh Valley News)

ELECTRIC VEHICLES:

AFFORDABILITY: Connecticut’s U.S. House delegation wants the state’s utility commission to help alleviate financial pressure on residential ratepayers facing high utility bills. (Hartford Courant)

POLITICS: A New Hampshire newspaper details how the state’s four gubernatorial candidates have described their future climate and energy policies. (New Hampshire Bulletin)

COMMENTARY:

OIL & GAS: Researchers find highly elevated oil and gas-related air pollution in a mostly Latino Permian Basin community, but federal regulators have yet to intervene. (Capital & Main)

PUBLIC LANDS: Utah files a lawsuit seeking control of some 18.5 million acres of unappropriated federal lands in the state, claiming Biden administration regulations hamper oil and gas and other development. (Associated Press)

COAL: The U.S. EPA tentatively rejects parts of Utah regulators’ plan to reduce smog-forming emissions from two coal power plants in the central part of the state. (E&E News, subscription)

GEOTHERMAL: California regulators extend the public comment period for proposed geothermal plants near the Salton Sea after environmental justice groups raise concerns. (Holtville Tribune)

SOLAR: A company brings a 200 MW solar installation online to help power its gold mine in Nevada. (news release)

WIND:

CLEAN ENERGY:

GRID:

UTILITIES: Montana regulators order NorthWestern Energy to provide more information before they will consider the utility’s proposed rate hike. (Daily Montanan)

CLIMATE:

ELECTRIC VEHICLES: California awards a San Francisco Bay Area ferry service $5 million to install floating charging stations. (RTO Insider, subscription)

BIOFUELS: A western Colorado county supports studying the feasibility of establishing sustainable aviation fuel production facilities in the region. (Biofuels Digest)

The pair of 1950s-era coal plants bailed out under Ohio’s House Bill 6 law are likely to remain unprofitable even after a surge in grid operator payments to generators, experts say.

The PJM Interconnection grid market makes capacity payments to line up power to meet expected demand in the years ahead. Aging, uneconomical coal plants are being retired at a time when data centers and manufacturers are starting to use more electricity, causing future power generation prices to rise.

But even record-high prices in PJM Interconnection’s recent capacity auction won’t cover the hundreds of millions of dollars in subsidies paid by ratepayers to cover Ohio utilities’ costs for the Ohio Valley Electric Corporation’s Kyger Creek and Clifty Creek power plants.

“Even with a super high price, OVEC is still going to be in the red,” said Neil Waggoner, Midwest manager for the Sierra Club’s Beyond Coal campaign.

The ratepayer subsidies are a result of HB 6, the 2019 state law at the heart of the largest corruption scheme in Ohio’s history. Republican legislative leaders have blocked all efforts to repeal the coal subsidies from coming to a floor vote.

This year alone, ratepayers are on track to pay nearly $200 million to prop up the two plants, one of which is in Indiana. By 2030, total ratepayer costs from the bailout could exceed $1 billion, according to RunnerStone, a consultant for the Ohio Manufacturers’ Association.

Starting next summer, the payments for generators to be ready to supply electricity when PJM Interconnection needs it will jump to about nine times the current rate for most of the grid operator’s service region.

“Put simply, the market pays participants for the promise to produce electricity when called upon by PJM,” said Daniel Lockwood, a spokesperson for the regional grid operator. An auction sets the levels for each year’s capacity payments, and the payments go to generators that bid the clearing price or less.

A spokesperson for the power plants did not directly answer the Energy News Network’s question about whether both cleared the latest PJM auction, although he described the auction results as “positive.”

“The auction results were a positive development for the OVEC plants and are more broadly a signal to the market that additional generation resources are needed in the PJM region,” said Scott Blake, a spokesperson for American Electric Power and Ohio Valley Electric Corp. While the HB 6 rider charges depend on multiple factors, the impact of the 2025/2026 capacity pricing “is expected to be positive for customers,” he said.

AEP is OVEC’s largest shareholder, along with other utility companies in Ohio and other states.

HB 6’s OVEC subsidies currently require Ohio’s residential utility customers to pay between $1.30 and $1.50 per month, depending on whether their utility is owned by AEP, AES Ohio, Duke Energy or FirstEnergy, according to PUCO data from spokesperson Brittany Waugaman. Businesses pay for the rider, too. The HB 6 rider’s net total costs last year were more than $148 million.

While capacity payments will reduce the OVEC plants’ total costs to Ohio ratepayers, the revenue won’t, in itself, make the plants profitable.

Expert testimony from a Michigan case last year found the OVEC plants would need capacity payments averaging about $418/MW-day for several years to become economical. Last month’s record-high price that will take effect next summer was about $270/MW-day.

Economic analyst Devi Glick of Synapse Energy Economics testified in the case on behalf of the Sierra Club.

“To massively oversimplify the economics of the OVEC plants, there are two categories of costs and two categories of revenues,” Glick told Energy News Network. “Costs are on one side of the equation and revenues on the other.”

Based on then-current projections for costs and energy market revenue, Glick calculated what the plants’ capacity revenues would have to be for the equation to balance out.

Several caveats would apply, Waggoner acknowledged, including any differences from last year to this year that could affect projected energy revenues. Nonetheless, he noted, a significant gap would remain.

Glick’s estimate of about $418 as a break-even capacity price for the OVEC plants is realistic and may even be conservative now, said John Seryak, managing partner for RunnerStone.

“PJM is no longer paying for a coal plant’s full power capacity anymore under new rules it created just prior to this capacity auction,” Seryak explained. “That could mean that OVEC needs even higher-priced capacity and energy to be profitable.”

“Future energy market prices, OVEC’s future coal costs, and OVEC’s environmental compliance costs will also be important factors determining the extent of its losses or profitability,” Seryak continued. “All that said, we do not anticipate OVEC operating at a profit without further price increases.”

Blake emphasized the OVEC plants’ role as a “reliable generation resource for our customers and for our region,” adding that the HB 6 rider “ensures that customers in Ohio receive electricity from OVEC for what it costs to produce it and the funds are used to pay down debt with no proceeds going to shareholders.”

That’s not exactly correct, said attorney Kimberly Bojko at Carpenter Lipps, who represents the Ohio Manufacturers’ Association in cases at the Public Utilities Commission of Ohio. “Customers pay the cost to operate and run OVEC and the power produced from OVEC is then sold into the wholesale electric market,” she said. Any revenue offsets the costs of HB 6’s coal subsidy.

The Ohio Manufacturers’ Association also has disputed the use of the HB 6 rider to pay down the OVEC plants’ debt in cases before the PUCO.

“By using ratepayer funds to pay down its debt, AEP Ohio is essentially shifting its bad debt to the Ohio ratepayers,” Seryak said. “It’s akin to if a person forced their neighbor to pay for their mortgage payment.”

“Customers pay for more than just OVEC’s debt, though,” Seryak added. “Customers also pay for losses in the energy market OVEC incurs. When this occurs, it means the electric grid does not need OVEC for reliability. Instead, OVEC is burning coal pointlessly at a loss and charging it to Ohio’s ratepayers.”

WIND: Federal ocean energy regulators give the country’s first floating offshore wind research lease to Maine for a project of up to 12 turbines near Portland; the state first sought the lease in 2021. (Associated Press)

ALSO: Federal officials grant $89 million to Eversource to develop its Huntsbrook Offshore Wind Hub on the southeastern Connecticut coast, building a new interconnection point for future projects. (news release)

GRID:

ELECTRIC VEHICLES:

SOLAR:

FOSSIL FUELS: Pennsylvania’s energy production will collapse, making it a “Third World” state, if Vice President Kamala Harris becomes president and enacts her fracking policies, former President Donald Trump claims. (Philadelphia Inquirer)

UTILITIES:

TRANSPORTATION: The Northern New England Passenger Rail Authority seeks public comment on its plan to build a new Amtrak station for Portland that would reduce Downeaster trip times by an estimated 15 minutes. (Portland Press Herald)

FLOODS: A storm sweeps New England, dropping historic rainfall totals on parts of Connecticut and New York and causing widespread floods; Connecticut officials expect a lengthy recovery. (NBC News, CT Mirror)

COMMENTARY: PJM Interconnection pushes back on criticism that its planning processes aren’t helping accelerate the energy transition, saying its power grid reforms are working. (Baltimore Banner)

CARBON CAPTURE: Oil companies are pinning their decarbonization hopes on carbon capture projects to reduce their emissions, but rising construction costs and the lagging pace of related infrastructure development are cutting into the value of federal tax credits for the technology. (Houston Chronicle)

EFFICIENCY: Critics slam Kentucky Power for its failure to be more ambitious with its energy efficiency programs amid data showing the utility’s poorest ratepayers used more electricity than average. (Kentucky Lantern)

SOLAR:

OIL & GAS:

ELECTRIC VEHICLES: Electric vehicle registration in a metro Tennessee county has surged nearly sevenfold since 2019. (Chattanooga Times Free Press, subscription)

GEOTHERMAL: A Houston-based startup announces construction of a 3 MW geothermal energy storage facility on land leased from an electric cooperative at the site of a coal mine and coal-fired power plant. (Houston Chronicle)

GRID: Georgia Power tracks the state’s growing number of data centers and their demand on the power grid, including a company’s proposal to build two more in the Atlanta metro region. (Atlanta Business Chronicle, subscription)

COAL: The family of West Virginia Gov. Jim Justice files for an injunction to stop the forced auction of a historic state resort that’s become the crown jewel of the coal baron’s business empire. (WV Metro News)

UTILITIES: A judge denies Texas utility CenterPoint Energy’s attempt to withdraw its request for a rate increase after receiving criticism over its response to Hurricane Beryl, prompting hopes by consumer advocates that regulators may order a rate decrease instead. (Houston Chronicle)

POLITICS: Georgia has received outsized benefits and investment under the federal climate package, but those gains could be undone if Donald Trump wins reelection. (Canary Media)

COMMENTARY:

GRID: Experts weigh in on how the Federal Energy Regulatory Commission’s newly adopted transmission rules might take shape under a Harris or Trump presidency, and how permitting legislation or a Supreme Court ruling could affect them. (E&E News)

POLITICS:

ELECTRIC VEHICLES:

WIND: Federal ocean energy regulators give the country’s first floating offshore wind research lease to Maine for a project of up to 12 turbines near Portland; the state first sought the lease in 2021. (Associated Press)

CLEAN ENERGY:

CARBON CAPTURE: Oil companies are pinning their decarbonization hopes on carbon capture projects to reduce their emissions, but rising construction costs and the lagging pace of related infrastructure development are cutting into the value of federal tax credits for the technology. (Houston Chronicle)

OIL & GAS: Aggressive sales tactics and “compulsion” laws means many Ohio landowners with fracking wells on their properties were forced to accept them, according to a new study. (The Hill)

SOLAR: A solar company’s partnership with a Minnesota agriculture nonprofit helps emerging farmers from around the world grow crops alongside community solar projects. (Sahan Journal)

HYDROGEN: A New Mexico electric cooperative looks to establish a green hydrogen production facility at a defunct mine and Superfund site in the northern part of the state. (High Country News)

SOLAR: Developers break ground on a 140 MW solar-plus-storage installation on the Jicarilla Apache Nation in northern New Mexico. (Albuquerque Journal)

ALSO:

CLEAN ENERGY:

OIL & GAS:

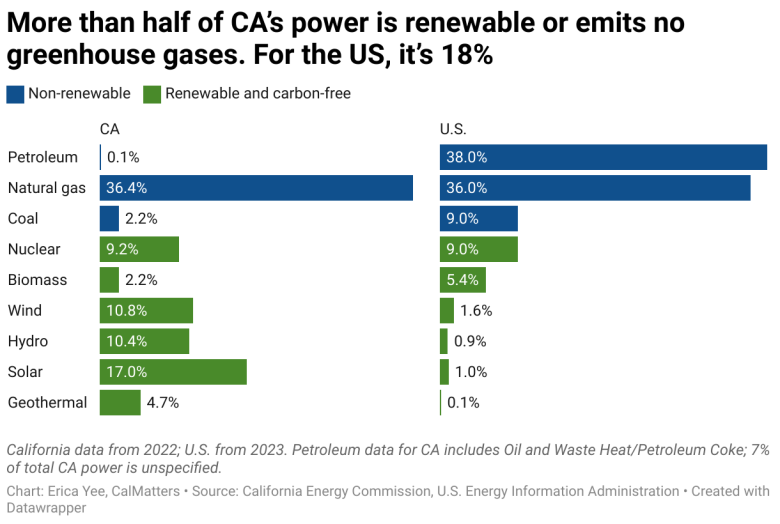

GRID: Data show natural gas remains California’s largest single energy source even though renewable, carbon-free sources provided 100% of the state’s electricity during 100 days so far this year. (CalMatters)

UTILITIES: A Washington state clean energy grant program has awarded $200 utility bill credits to about 50,000 low-income families since launching in July. (Spokesman-Review)

CLIMATE:

TRANSPORTATION: California regulators abandon a proposal to require jet fuel suppliers to pay for greenhouse gas emissions, saying it will look to incentivize sustainable fuel production instead. (E&E News, subscription)

COAL: Federal researchers find a Canada coal mine is sending pollution some 350 miles downstream and across the border to the Columbia River in the Northwest. (Montana Free Press)

ELECTRIC VEHICLES: San Francisco Bay Area cities consider establishing electric bicycle regulations following an increase in related accidents. (Mercury News)

Stay up-to-date with free briefings on topics that matter to all Californians. Subscribe to CalMatters today for nonprofit news in your inbox.

California has given America a glimpse at what running one of the world’s largest economies on renewable energy might look like.

The state recently hit a milestone: 100 days this year with 100% carbon-free, renewable electricity for at least a part of each day, as tracked by Stanford University engineering Professor Mark Z. Jacobson.

The state notched the milestone while — so far — avoiding blackouts and emergency power reductions this year, even with the hottest July on record.

That progress is largely due to the substantial public and private investments in renewable energy — particularly batteries storing solar power to use when the sun isn’t shining, according to energy experts.

“California has made unprecedented investments in our power grid in recent years — and we’re seeing them pay off in real time,” Gov. Gavin Newsom said in a statement to CalMatters. “Not only is our grid more reliable and resilient, it’s also increasingly running on 100% clean electricity.”

The state faces a huge challenge in coming years: A series of mandates will require carbon-free energy while also putting more electric cars on roads and electric appliances in homes. California, under state law, must run on 60% renewable energy by 2030, ramping up to 100% by 2045.

Signs of progress are emerging. From January to mid-July of this year, zero-carbon, renewable energy exceeded demand in California for 945 hours during 146 days — equivalent to a month-and-a-half of 100% fossil-fuel-free electricity, according to the California Energy Commission, the state agency tasked with carrying out the clean energy mandates.

But California still has a long way to go to stop burning fossil fuels for electricity. Natural gas, which emits greenhouse gases and air pollutants, remains its single largest source of electricity.

Just over half of power generated for Californians in 2022 came from solar, wind, other renewables and nuclear power, while 36% came from natural gas plants.

Reliability of the power grid is a top concern as the state switches to solar and wind energy. Unpredictable events like wildfires and winter storms also cause outages, while hot summer months, with air conditioners whirring, strain the supply.

In August of 2020 California experienced its first non-wildfire blackouts in nearly 20 years, and in late August and September of 2022, a severe heatwave forced regulators to ask consumers to voluntarily reduce power for 10 days.

Since September 2022 — when California teetered on the edge of those blackouts and the governor pleaded for conservation — nearly 11,600 new megawatts of clean energy have been added to the state’s grid, said Elliot Mainzer, chief executive of the California Independent System Operator, which manages the grid. (That’s enough to power around 9 to 12 million homes although it’s not available all at one time.)

California also now has more than 10,000 megawatts of battery capacity, making it the largest supply outside of China. Battery power from large commercial facilities proved its worth during last month’s heat wave, Mainzer said.

Batteries “were a major difference-maker,” Mainzer said. “The batteries charged during the day, when solar energy is abundant, and then they put that energy back onto the grid in the afternoon and evening, when solar production is rolling off the system.”

California relies heavily on four-hour duration lithium-ion batteries, which come in large, centralized facilities and hybrid facilities paired with solar energy projects. More homes also are installing batteries with their rooftop solar installations, but they supply a small amount of power.

Planning and practicing various emergency scenarios has also helped immensely, Mainzer said.

“Our grid operators are now increasingly experienced at managing these extreme heat events,” Mainzer said. “Our forecasters also did an excellent job of reviewing the next day’s conditions so that the market could respond effectively.”

California may need to more than double its energy generation capacity by 2045 to meet the 100% clean energy target while adding electric cars, appliances and other technologies, said Siva Gunda, who sits on the California Energy Commission.

To do that, California aims to build about 6,000 to 8,000 megawatts of new energy resources each year. The state hit a record last year, adding more than 6,000 megawatts, Gunda said. Each megawatt is enough to serve between 750 and 1,000 homes.

“The table is set,” Gunda said. “The pieces are there for success, and it’s about executing it, together with a common vision and collaboration.”

The commission is closely monitoring a new concern: Artificial intelligence technology, which uses large data centers that consume power. “We’re carefully watching where the loads are going to grow,” Gunda said.

Stanford’s Jacobson said running on 100% renewable energy is becoming more common.

Over the July 28 weekend, California marked the 100th nonconsecutive day within a 144-day stretch in which 100% of electricity came from renewable sources for periods ranging from five minutes to more than 10 hours, he said.

On April 8, a solar eclipse reduced solar power generation and increased demand on the grid, which was met by batteries. On May 5, wind, hydroelectric and solar energy reached more than 160% of demand for a significant portion of the day.

California continues to waffle about ending its reliance on natural gas and nuclear power.

Fearing emergency rolling blackouts like the one in 2020, Newsom and the Legislature in 2022 allowed some natural gas plants that were supposed to go offline to keep operating.

And the Diablo Canyon nuclear power plant will continue operating while Pacific Gas & Electric pursues federal permission to stay open past 2025. Nuclear power is considered renewable and carbon-free but it creates radioactive waste.

State officials and private investors aim to create an entirely new industry — giant floating ocean wind platforms — to produce 13% of California’s power, enough to power 25 million homes, by 2045. The massive projects will cost billions of dollars.

Some Democratic legislators are hoping to make it easier to build wind and solar projects, since sometimes local obstacles and permitting take years. They are negotiating an end-of-session package of proposed laws that could streamline construction, CalMatters reported earlier this month. California’s legislative session ends Aug. 31.

Jacobson said the cost of large-scale solar power projects has “dropped substantially” in recent decades largely because of “economies of scale — just the huge growth of solar on a worldwide scale.”

“There’s no miracle technology that was developed,” he said. “It’s just subtle improvements in existing technologies and deployment, deployment, deployment.”